Liquify Smarter, faster, better

The Order-to-Cash Platform For The AI Era

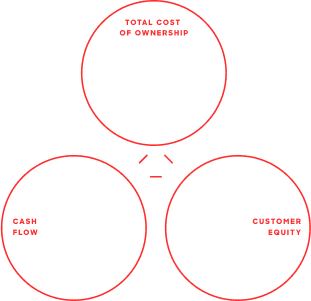

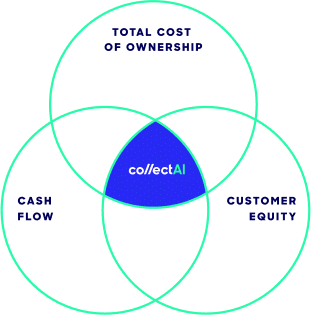

collect.AI is the next generation order-to-cash platform for the AI era. European enterprises realise their receivables faster, more intelligently and more sustainably with our AI solution. For optimised cash flow, lower costs and stronger customer relationships.

+50 European Enterprises – over € 7.1 billion in receivables volume since 2021 – with collect.AI

Hello future

Optimise Your Cash Flow End-to-End

By using collect.AI, you can optimise the life cycle of your receivables from the time they arise until they are paid. Always aiming to reliably convert receivables into liquidity before they are due.

Hello future

Optimise Your Cash Flow End-to-End

By using collect.AI, you can optimise the life cycle of your receivables from the time they arise until they are paid. Always aiming to reliably convert receivables into liquidity before they are due.

Gamechanger

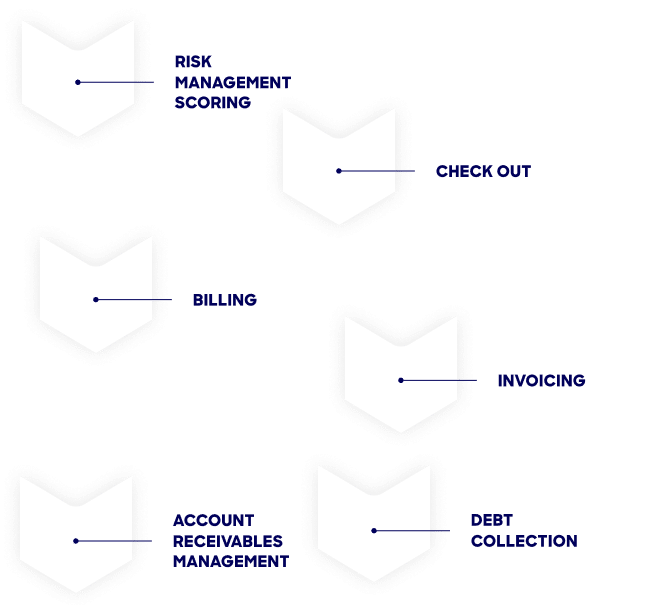

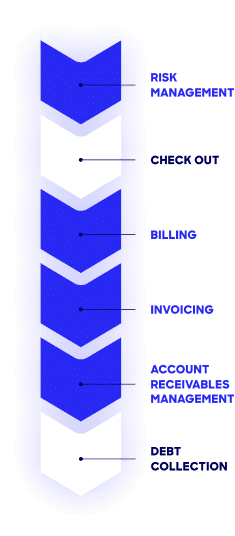

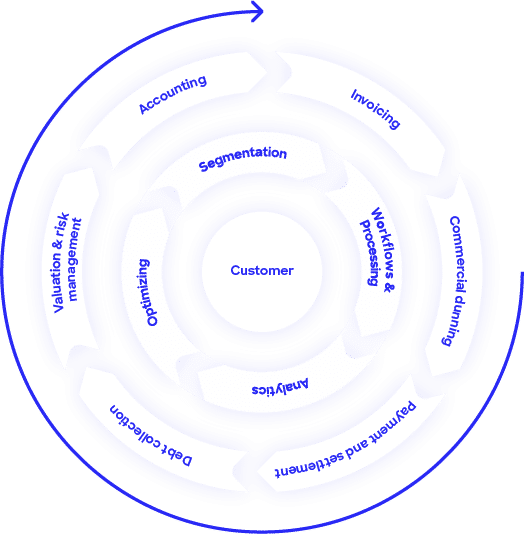

The Order-to-Cash Value Chain: End-to-End & AI-optimized

Without collect.AI the value chain is fragmented, asynchronous & inefficient.

Departmental silos, outdated IT systems and rigid linear processes are a competitive disadvantage. Digitalisation and artificial intelligence are making traditional receivables management increasingly expensive and inefficient. Additionally, rising interest rates and inflation increase the entrepreneurial risk.

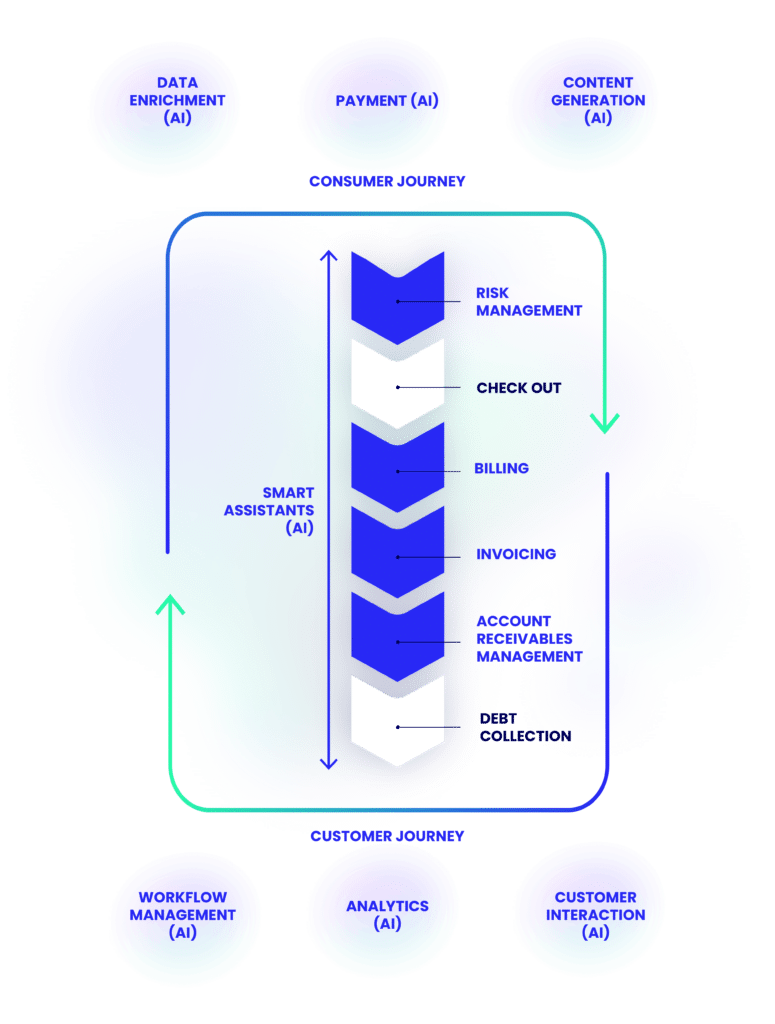

With collect.AI your order-to-cash becomes harmonised, synchronised & efficient.

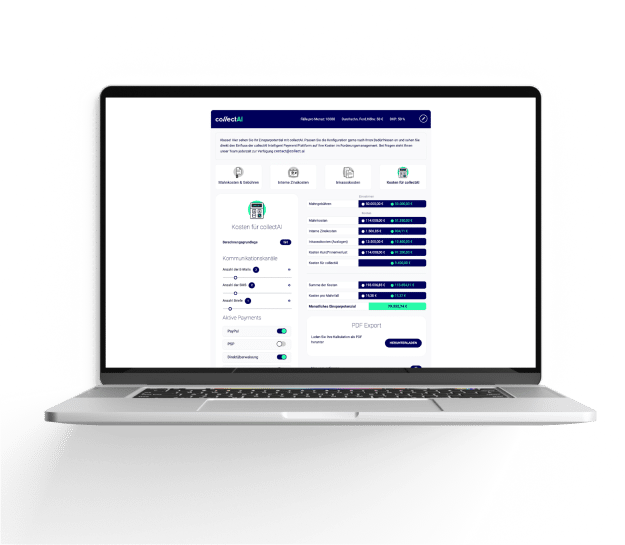

The collect.AI platform is an ecosystem that relies on best practice, integrations and network effects. It standardises and manages data and processes between all systems that are involved in receivables management. The result: increased cash flow, reduced costs and increased customer lifetime value.

AI assistants optimise your O2C performance.

Smart AI assistants recognise patterns in payment behavior, optimise and manage individual workflows, interact bidirectionally with your customers and perform success and risk calculations. This relieves the strain on your business resources. You always know what the “next best action” is and learn from your customers’ behavior.

Are you ready for the AI era?

If so, utilise the powerful leverage of the AI behind collect.AI now and move your order-to-cash and receivables management process into a new era. Make liquidity more predictable and accelerate your cash flow. Reduce receivables management costs and maximise the customer lifetime value of your customer relationships. All with just one platform.

Liquify smarter, faster, better.

Gamechanger

The Order-to-Cash Value Chain:

End-to-End & AI-optimised

Without collect.AI the value chain is fragmented, asynchronous & inefficient.

Departmental silos, outdated IT systems and rigid linear processes are a competitive disadvantage. Digitalisation and artificial intelligence are making traditional receivables management increasingly expensive and inefficient. Additionally, rising interest rates and inflation increase the entrepreneurial risk.

With collect.AI your order-to-cash becomes harmonised, synchronised & efficient.

The collect.AI platform is an ecosystem that relies on best practice, integrations and network effects. It standardises and manages data and processes between all systems that are involved in receivables management. The result: increased cash flow, reduced costs and increased customer lifetime value.

AI assistants optimise your O2C performance.

Smart AI assistants recognise patterns in payment behavior, optimise and manage individual workflows, interact bidirectionally with your customers and perform success and risk calculations. This relieves the strain on your business resources. You always know what the “next best action” is and learn from your customers’ behavior.

Are you ready for the AI era?

If so, utilise the powerful leverage of the AI behind collect.AI now and move your order-to-cash and receivables management process into a new era. Make liquidity more predictable and accelerate your cash flow. Reduce receivables management costs and maximise the customer lifetime value of your customer relationships. All with just one platform.

Liquify smarter, faster, better.

The AI from collect.AI

The best-trained AI for your O2C process

01

Proven

AI models

For numerous industries, customer

Clusters, use cases and target

Scenarios.

02

Unique data pool

The AI network effect and the high quality of the data enable extraordinary results.

03

Flexible automation

You determine the level of AI automation and are in control.

04

State of the art AI tool box

We use reinforcement learning, natural language processing, gradient boosting, contextual bandits and deep Q networks.

05

EU AI Act ready &

GDPR-compliant

As a portfolio company of Aareal Bank Group, we meet the highest regulatory standards.

06

AI optimizes your results

AI also has a positive impact on cash flow, customer equity and costs.

07

Reliably fit for the future

Since 2016 – continuously optimized by leading data scientists using the latest methods.

Entwickelt für Europäische Corporates

collect.AI ist 100 % enterprise ready

collect.AI – an Aareal Bank Group Company

Since 2016 – a pioneer of AI development in Europe

including insurance companies, banks, utilities, mobility, telco, media, clubs & e-commerce.

Financial and industry experts, data scientists, software engineers, dialog & conversion specialists.

Litigated receivables volume since 2021. Already more than € 1.8 billion in the first half of 2023.