DATA ENRICHMENT AI

Data enrichment AI for an efficient order-to-cash process

The quality of your customer data is crucial for an efficient order-to-cash process. Data Enrichment AI delivers premium-quality data: Artificial intelligence optimises data quality from the very first customer contact – for fewer payment disruptions in receivables management and greater efficiency in the entire order-to-cash process.

STATUS QUO

Lack of Data Enrichment Leads to Challenges Due to Inadequate Customer Data

In today’s business world, digital customer data plays a crucial role in a company’s success. Provided they are correct and complete. However, a recent study revealed considerable deficiencies in data quality: around one in eight addresses in the customer master data of many organisations is incorrect.

In addition to addresses, payment and communication data are also deficient. The reasons for this manifest themselves along the entire customer journey, for example because customers do not communicate changes to their mobile phone number or address or they make mistakes when creating customer profiles or because companies generally request too little data.

Poor Payment Rates and Long Outstanding Debts Are Often Caused by Outdated Customer Data.

9.000.000

address changes per year occur due to moves

> 6.7 %

of all letters are undeliverable

> 11,000,000

New mobile phone numbers are issued every year

300,000

name changes due to weddings every year

300-180

days blocking period for deregistered mobile numbers

These continuous changes to customer master data, payment data and communication data result in poor data quality and an increased risk of GDPR violations.

What Happens When Data

Are Faulty or Outdated?

Incorrect or outdated data increases your business process costs and the risk of data breaches – for example, if it is not possible to obtain consent for updated data protection regulations due to incorrect contact details.

However, according to an IDC survey, the continuous optimisation of data quality is a key challenge for 37% of German companies. The complex data maintenance exceeds the capabilities of existing legacy systems, among other things.

Many teams also lack a 360° customer view, from marketing communication to receivables management. This limited view has serious consequences for the order-to-cash process (O2C) in particular. The O2C process thrives on information provided by customers. If inconsistencies occur or data is incomplete, this leads to

- incorrect invoices,

- poor payment rates,

- long outstanding amounts,

- dissatisfied customers, and

- a long-term deterioration in cash flow.

The Importance of Data Enrichment

Data enrichment, also known as data enhancement, is a decisive step towards improving data quality and meeting customer needs in a targeted manner. This refers to the process of improving and expanding data sets, for example through data enrichment services such as adding relevant information or data validation.

The result: Data enrichment makes it possible to optimise the quality and informative value of data. This provides companies with a sound basis for better decisions, more efficient business processes and strong customer relationships. You can achieve these goals with Data Enrichment AI from collect.AI.

The Future

Data Enrichment AI With collect.AI

With the Data Enrichment AI, you save internal resources that would otherwise be required for data enrichment and verification. collect.AI allows you to delegate the process of data enrichment to an AI technology that has been trained with more than 100 million transaction data from EU enterprises in various sectors.

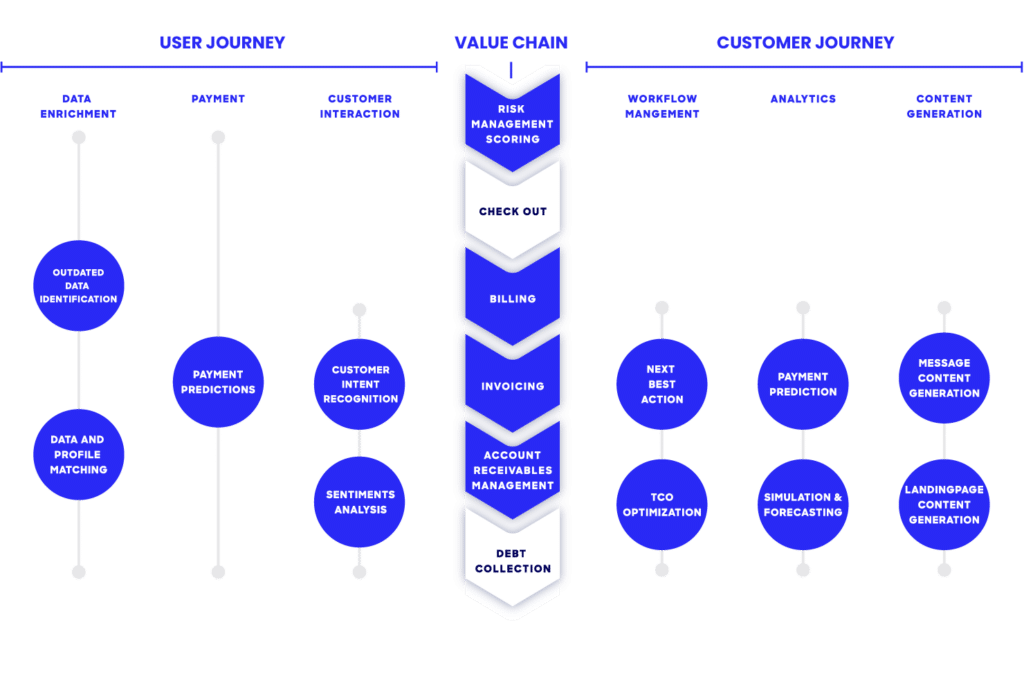

Data Enrichment AI shows its strength above all in the order-to-cash process: The AI-based tool is one of four AI assistants on collect.AI’s order-to-cash platform. This enables companies to handle the entire life cycle of a receivable end-to-end, fully digitally and AI-optimized.

The Benefits of Data Enrichment AI For Your Order-to-Cash Process

Data Enrichment AI continuously increases the efficiency of your communication, transaction and payment processes. It ensures that customer contact data is always up to date. At the same time, it enables an increase in the approval rates for legally binding advertising consents and direct debit mandates.

Data Enrichment AI supports your company in

- improving your data quality

- continuously increasing the efficiency of your O2C process

- conserving resources during data validation

- using public databases or other sources

- better understanding your customers and their behavior and individual needs

- strengthening customer relationships in the long term

- maintaining compliance and data protection

- relieving the accounts receivable department

- improving the receivables management process

The AI assistance also optimises the payment rate: collect.AI customers use Data Enrichment AI to collect 90% of their receivables before they are due and therefore reduce their process costs in the O2C process by an average of 30%.

Maximise effectiveness

Digital Order-to-Cash and Receivables Management

By using collect.AI, you can significantly increase the performance values of your receivables management.

DATA SUBMISSION IN PRACTICE

How Companies Work with Data Enrichment AI

Companies with 5,000 to 20,000 or more recurring receivables per month use Data Enrichment AI. These include regional energy suppliers who need to effectively digitise their traditional O2C processes in order to retain customers who are willing to switch. They must offer modern and simple payment processes and at the same time ensure their customers’ ability to pay in times of rising energy prices.

Data enrichment with AI improves the necessary database:

- Data validation when ordering: Address validation is carried out by external data sources when the tariff is concluded. This ensures, for example, that the desired tariff is available at the address and that invoices are addressed correctly later.

- Support for receivables management: If a customer has payment difficulties, the customer data can be enriched with relevant information from debtor databases. For example, a statement of assets can be used to check creditworthiness in order to take measures to restore payment.

- Personalised support: The enrichment of customer data with historical consumption data and demographic information makes it possible to identify the optimal tariff. This increases customer satisfaction and willingness to pay.

The AI from collect.AI

The best-trained AI for your O2C process

01

Proven

AI models

For numerous industries, customer

Clusters, use cases and target

Scenarios.

02

Unique data pool

The AI network effect and the high quality of the data enable extraordinary results.

03

Flexible automation

You determine the level of AI automation and are in control.

04

State of the art AI tool box

We use reinforcement learning, natural language processing, contextual bandits and deep Q networks.

05

EU AI Act ready &

GDPR-compliant

As a portfolio company of Aareal Bank Group, we meet the highest regulatory standards.

06

AI optimizes your results

AI also has a positive impact on cash flow, customer equity and costs.

07

Reliably fit for the future

Since 2016 – continuously optimized by leading data scientists using the latest methods.