Order-to-Cash 5.0

Mit künstlicher Intelligenz, Daten & smarten Assistenten

Nutzen Sie die Potenziale von Daten und Netzwerk-Effekten, um die Effektivität Ihrer O2C-Strategie entscheidend zu verbessern. Mit der Erfahrung aus mehreren 100 Millionen Verbrauchertransaktionen für verschiedene Geschäftsmodelle und Branchen, verfügt die collect.AI-Plattform über einzigartige Einblicke und kennt die Erfolgsparameter für den effizientesten O2C-Prozess – und zwar individuell für jeden einzelnen Ihrer Kunden.

DatenModelle und -qualität

Mehr Daten im Netzwerk = höhere Präzision, bessere Entscheidungen, berechenbare Ergebnisse

Die isolierte KI-Strategie ist ein stark limitierender Faktor und Wettbewerbsnachteil für Unternehmen.

Konzerninterne Datensilos sowie die fehlende Vernetzung zwischen Unternehmen und Branchen limitieren das eigene O2C-Performance Potenzial stark. Die eigene Benchmark ist immer nur so gut wie die eigenen Daten und die daraus resultierenden Erkenntnisse.

Der Wert eines Netzwerks steigt im direkten Verhältnis zu Dessen Größe.

Netzwerk-Effekte & qualitative Daten steigern die Wirksamkeit exponentiell.

Durch den Einsatz einer Cloud-KI-Plattform brechen Sie konzerninterne Datensilos auf und partizipieren von den Netzwerkeffekten sowie von kontinuierlich angereicherten und aktuellen Daten.

Der Wert des Netzwerkes steigt zum Quadrat durch Datenvielfalt und -qualität.

Jede Transaktion im Netzwerk steigert die O2C- Effizienz von allen Teilnehmern.

Aus der Erfahrung von mehr als 100 Millionen Transaktionen, 10 Millionen Consumer-Daten und diversen Geschäftsmodellen kennt collect.AI die Erfolgsparameter für den wirksamsten O2C-Prozess – und das für jeden einzelnen Ihrer Kunden.

Der KOmbinierte Datenpool bei COLLECT.AI erzeugt einen gehEbelten netzwerkeffekt.

Die Isolierte KI-Strategie ein stark limitierender Faktor und Wettbewerbsnachteil für Unternehmen

Konzerninterne Datensilos sowie die fehlende Vernetzung zwischen Unternehmen und Branchen limitieren das eigene O2C-Performance Potential stark. Die eigene Benchmark ist immer nur so gut wie die eigenen Daten und den Erkenntnissen aus diesen.

Der Wert eines Netzwerks steigt im direkten Verhältnis zu Dessen Größe.

Netzwerk-Effekte & qualitative Daten steigern die Wirksamkeit exponentiell

Durch den Einsatz einer Cloud KI-Plattform brechen Sie konzerninterne Datensilos auf und partizipieren von den Netzwerkeffekten sowie won kontinuierlich angereicherten und aktuellen Daten.

Der Wert des Netzwerkes steigt zum Quadrat der Nutzeranzahl im Netzwerk.

Jeder Transaktion im Netzwerk steigert die O2C- Effizienz von allen Teilnehmern

Aus der Erfahrung von mehr als 100 Mio. Transaktionen, 10 Mio. Consumer-Daten und diversen Geschäftsmodellen, kennt collect.AI die Erfolgsparameter für den wirksamsten O2C-Prozess – und dass für jeden einzelnen Ihrer Kunden.

DER KOMBINIERTE DATENPOOL BEI COLLECT.AI ERZEUGT EINEN GEHEBELTEN NETZWERKEFFEKT

KI-Module von collect.Ai

Die Wirksamkeit der KI-Assistenzsysteme

Volle Kontrolle

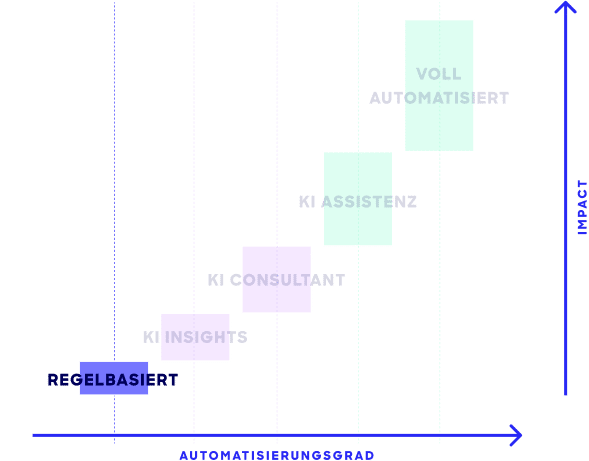

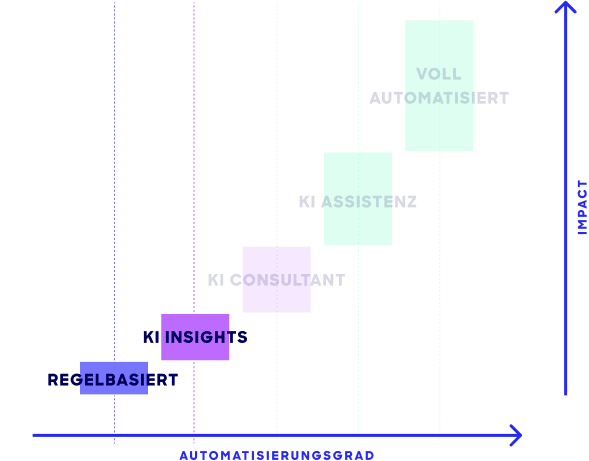

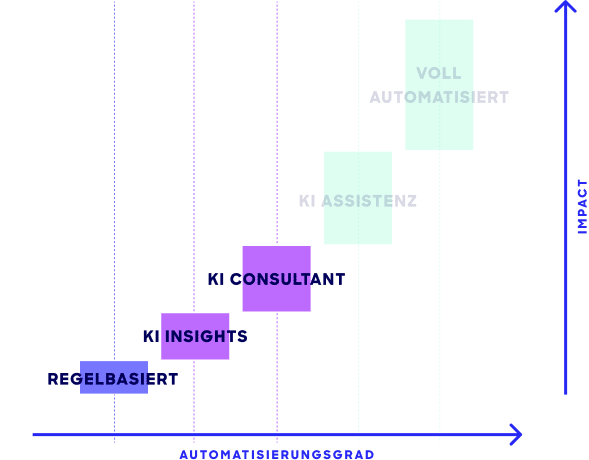

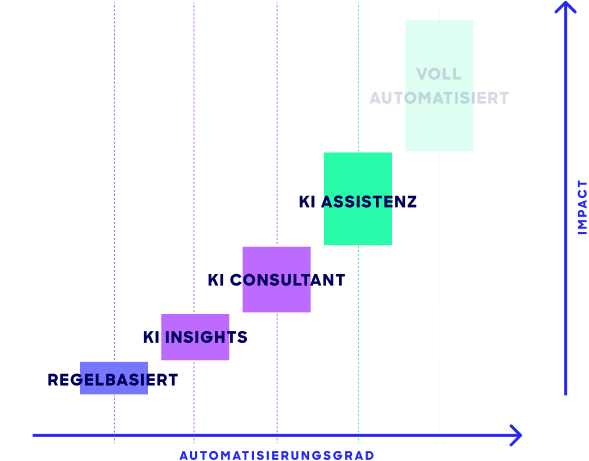

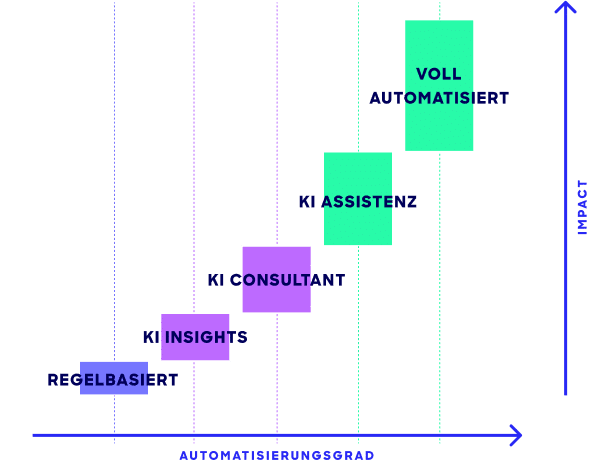

In 5 Stufen zum voll autonomen Forderungsmanagement

Bestimmen Sie den KI-Einsatzgrad und wählen Sie hier die gewünschte Stufe.

EU AI Act Ready & TÜV (DSGVO) zertifiziert

Daten sind Vertrauenssache

Seit 2016 leistet collect.AI einen wesentlichen Beitrag zum Einsatz von KI im Forderungsmanagement. Wir sind Teil der Aareal Bank Group und es ist unsere Mission, europäische Unternehmen darin zu befähigen, Cashflow durchgängig mit Hilfe von KI zu optimieren. Kundendaten von höchster Qualität und Aktualität sind die wesentliche Grundlage dafür. Deren Verarbeitung absolute Vertrauenssache. collect.AI ist EU AI Act ready und vom TÜV Saarland DSGVO-zertifiziert.

KI-Technologien & Methoden

Unsere KI-Tool Box

Learning

Bei diesem Ansatz lernt unsere KI durch Interaktion mit Daten. Sie optimiert Aktionen, um die Wirksamkeit zu steigern. Aus den Ergebnissen leitet die KI die effektivsten Strategien ab, um unsere Ergebnisse zu verbessern und den Erfolg der Maßnahmen zu maximieren.

Bei dieser Methode analysiert unsere KI menschliche Sprache. Sie versteht und generiert Texte basierend auf den erhaltenen Daten. Dieses „Wissen“ nutzen wir, um zum Beispiel im Kundendialog in Echtzeit effiziente Maßnahmen der Interaktion auszuwählen oder um entsprechende Workflows zu starten.

Bandits

Mit diesem Ansatz trifft unsere KI Entscheidungen basierend auf dem Kontext. Sie lernt aus den Ergebnissen und optimiert Handlungen für den maximalen Nutzen. Das gelernte „Wissen“ wird angewandt, um den besten Handlungsverlauf (Next best Action) zu bestimmen und den Serviceerfolg zu erhöhen.

Networks

Hierbei bewertet unsere KI Aktionen im Zusammenspiel mit neuronalen Netzwerken. Sie lernt so, optimale Entscheidungen zu treffen. Aus den Erkenntnissen beschreibt sie Erfolgs-Szenarien und erhöht so die Wirksamkeit unserer Lösung stetig.